Art dealers claim droit de suite levy threatens London's art trade

Art dealers claim droit de suite levy threatens London's art tradeFrom New Year, dealers and auctioneers must pay artists' heirs up to 4% of the sale price of works sold for more than €1,000

It was the plight of the family of French painter Jean-François Millet, forced to live in poverty as his famed 1858 Angélus resold for 800,000 gold francs, that is said to have inspired the art sales levy known as droit de suite.

But some 130 years after his death Millet's legacy, which bequeathed artists and their heirs a small royalty each time a work was sold, has rent Britain's art world in two amid heated claims it threatens London's standing as a leading international art sales centre.

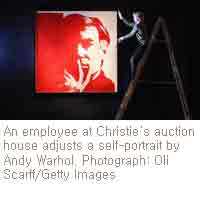

From New Year's Day under European legislation the UK's art dealers and auctioneers must pay the heirs or estates of artists deceased within 70 years up to 4% of the sale price of each work they sell for more than €1,000 (£840).

With Picasso, Matisse, Bacon, Lowry and Sickert all in this category, critics of Europe's imposition of Artist Resale Rights (ARR) claim the EU directive will put London at a competitive disadvantage with top art works going instead to rival markets in New York, Geneva and Hong Kong, where no such levy applies.

"Our argument is the same as the chancellor's against the European plan for financial transaction tax," said Anthony Browne, chairman of the British Art Market Federation, representing some 10,000 art business in the UK, and which is vehemently opposed to ARR. "If [ARR] existed worldwide, you'd have a level playing field. But it doesn't." Droit de suite – which translates as "the right to follow" – was introduced in France to help families of artists after the first world war and is operational in most EU countries.

It was implemented to "harmonise" art markets in Europe. But with London as the main modern and contemporary fine art European capital with 58% of trade, the UK cried foul, warning it would be disproportionately damaged.

Tony Blair won a hard-fought battle for a derogation in 2006 which meant that, in the UK, the levy would only be paid to living artists.

That derogation, however, runs out at midnight on 31 December. The coalition government abandoned the fight, say critics.

"They just didn't press hard enough," said Browne.

The battle is on for a review of the impact of the legislation in the UK in 2013, and for a reversal to protect this crucial part of the UK's £7.7bn art market. With passion high on both sides, this has been described as "the fox-hunting debate of the art world".

Supporters of ARR argue the royalty is tiny, starting at 4% for a work fetching more than €1000, but with the percentage gradually decreasing as the sale price rises, and capped at €12,500 [roughly £11,000].

"The cap doesn't hit until a work sells for over £2m," said Tania Spriggens, of the Design and Arts Copyright Society (Dacs), the main collecting agency for the royalty in the UK.

Claims that art vendors would forsake London were unfounded, she said. In the six years that the Dacs has collected ARR for living artists, there was "no evidence" sales were being diverted abroad. "If that really was the case, then a £11,000 royalty on a huge sale of a [Damien] Hirst would have had an impact. We haven't seen that," said Spriggens.

Hirst, reportedly Britain's richest artist, is a supporter of the extension of ARR to heirs and beneficiaries. "We need to recognise their role in preserving art. They spend a lot of time and energy on this," he said.

Cataloguing, preserving and validating collections are all currently done by heirs and estates without recompense.

The estate of LS Lowry agrees: "This income will be vitally important for the estates and will help us to continue promoting and preserving the important artistic legacy left of LS Lowry."

But not all artists are in favour of ARR. David Hockney and Gillian Ayres are among those who have said the levy does "little or nothing" for the "vast majority" of British artists, but envelops the art market in red tape, and discourages art dealers from buying works of emerging artists and those who have not achieved "celebrity" status.

"The original idea was to help artists who were young and starving in their garrets to get a little bit more from their art. But the reality is rather different," said Ivan Macquiten, editor of Antiques Trade Gazette, which is campaigning on the issue.

Dealers who might have bought a young artist's entire collection, were now more likely to take works on a "sale or return" basis, he said.

The median royalty paid to living artists by Dacs is £360. It has collected around £3m a year in royalties for living artists in the past six years, and envisages that rising gradually to £12m after heirs and estates are added from January.

Contemporary British artist Stuart Semple, 31, who has a two-year-old son, said: "The artist is at the bottom of the food chain. You see people making huge profits from your work.

"You made it, and you have no control. So it would be horrible if I passed away and my work was going for loads at auction, and my girlfriend was struggling to look after our son. It's not much. If you sell a Picasso, you're talking £80m. Compared to £11,000. Honestly, they'd spend more than that on champagne to celebrate the sale."

Vincent Kosman, who with his wife runs the online Louise Kosman gallery selling hundreds of works of modern British art annually for prices between £150 and £15,000, said the increase would deter the "lower-end and middle-market buyer.

"It's very sad the business should be damaged like this," he said.

Denys Wilcox, whose Court Gallery at West Quantoxhead, Somerset, specialises in modern British and French artists, said the royalty would encourage him and others to deal with earlier artists "not affected by it". The British Art Market Federation and others are lobbying the government to raise the threshold that ARR kicks in to €3,000.

Browne said recent research showed only three out of 100 artists benefited, with the biggest beneficiaries "those lucky enough to be descended from a very famous artist".

The losers would be "the antiquarian bookshop selling a low-value print, or small antique shop selling a £1,500 picture by a minor deceased 20th century artist", who would be "completely enveloped in red tape".

Browne added: "One of things we are expressing great concern to the government about is the cost of processing the resale right for low-value transactions, which are out of all proportion for the minute sums of money that eventually find their way into the pockets of the artists' heirs."

Caroline Davies and Esther Addley

guardian.co.uk, Thursday 22 December 2011 19.58 GMT Article history

Art dealers claim droit de suite levy threatens London's art trade

Art dealers claim droit de suite levy threatens London's art trade