정준모

2013년 전세계미술시장을 분석한 통계결과가 나왔습니다. 한국미술은 수입은 늘었지만 수출은 줄었다는 결론입니다. 뭐 당연한 일 아닌가 생각합니다.

그간 한국시장은 내수시장의 졸부들 또는 부자지만 격을 지니지 못한 사람들의 기호와 취미에 봉사하는 얼룩덜룩한 그림이나 캐릭터와 다를 것 없는 그림에 열중하는 화가들과 팔리는 그림만 쫒는 화상들의 어쩔 수 없는 장사치로서의 근성 그리고 비평의 부재와 미술문화의 증진을 위해 노력해야 할 미술관들은 예산과 인력이 없어 개점휴관상태고 일부 돈이 좀있는 지방미술관들의 경우 장롱면허로 학예연구직을 지켜와 연한을 채운 그 실전경험없는 경력으로 관장으로 임명된 자들, 그래서 관리자로서, 또 학예연구 업무와 기획과 행정등의 능력을 갖추지 못한 관장들에 의해 당장의 실적, 즉 관람객 증대가 미술관이 하는 일이라고 생각하고 일을 벌이는 총체적 부실이 한국미술의 현주소인데 큰 기대를 한다는 것 자체가 어불성설이라하겠습니다.

아무튼 찬찬이 살펴보시기 바랍니다.

-

Art Market Moved $66 Billion Last Year, Nearing Pre-Recession Levels

by Jillian Steinhauer on March 13, 2014

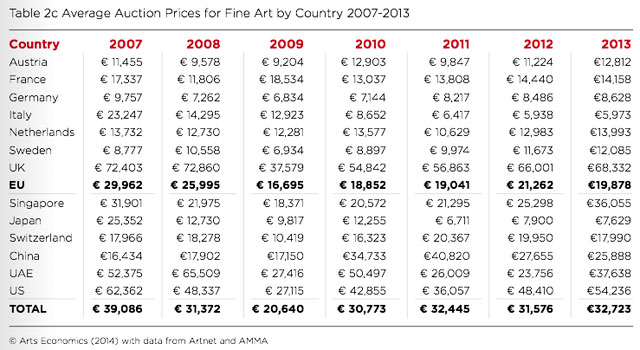

International art and antique market sales totaled €47.4 billion ($66 billion) last year, their highest sum since the pre-recession days of 2007, according to the European Fine Art Foundation (TEFAF)’s annual art market report, released yesterday. The report extensively examines the 2013 market, which grew 8% from the previous year and reflects an overall increase of more than 150% in the past decade.

One of the primary trends identified by Dr. Clare Mc Andrew, author of the report, will likely not come as a surprise to most people:

The volume of transactions in the global art market also increased in 2013, but by less than the growth in value, indicating that a significant part of the uplift of the market was due to higher priced works, rather than simply more works sold.

The art market, in other words, is top-heavy, mirroring the larger societal accumulation of the most of the world’s wealth in the hands of a small number of extremely wealthy individuals.

The report explains how this plays out at auctions:

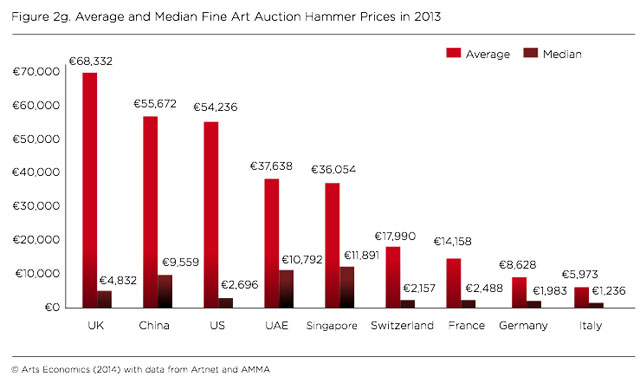

The lowest three price brackets of works sold for less than €50,000 accounted for 93% of all lots sold in 2013, despite only having accounted for 18% of total sales by value. … At the high end of the market, less than 0.5% of works at auction were sold for over €1 million, with these lots accounting for 44% of sales by value. The highest priced lots over €10 million also accounted for a tiny fraction of sales (less than 0.1%), but they still made up 16% of the market’s total value.

An examination of auction sales of the work of individual artists shows that the majority of sales by value are works of a very small group of artists. Of those artists whose works appeared on the auction market in 2013, the majority (55%) were sold for less than €3,000, and 90% for less than €50,000. The work of less than 1% were sold for over €1 million, and only a tiny fraction had top selling lots for over €10 million (less than 50 artists worldwide). … It is also true of the dealer market, with high-end dealers commenting that their top collectors appeared to be interested in the work of only about 50 to 100 artists.

The report also echoes a concern that’s been discussed a lot in the past year: the ongoing squeeze on the middle of the market. Mc Andrew found that dealers with sales between €500,000 and €10 million saw very low growth (only 2–3%) from 2012, while dealers with sales either over €10 million or under €500,000 grew substantially (11% and 12%, respectively).

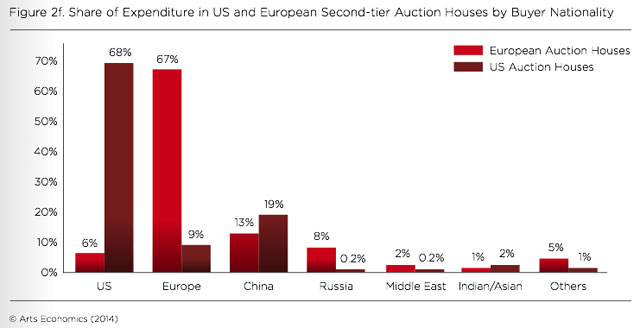

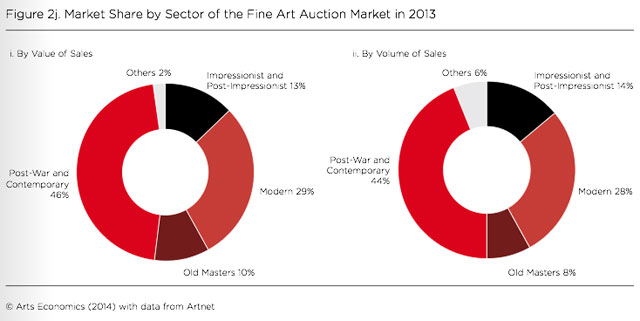

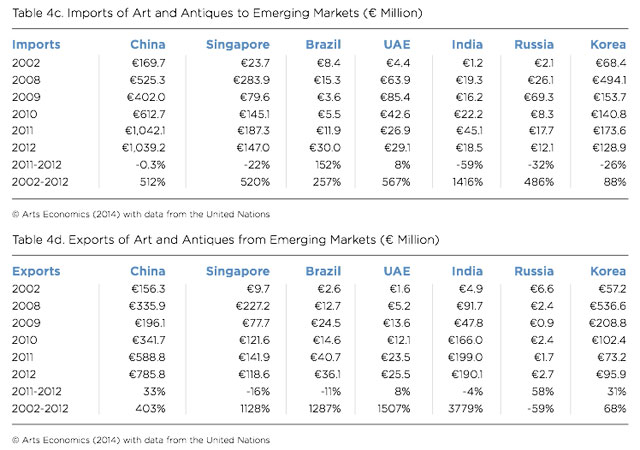

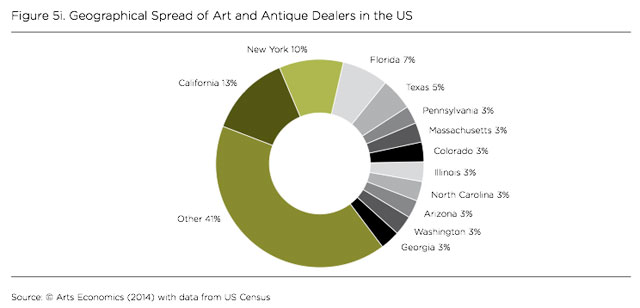

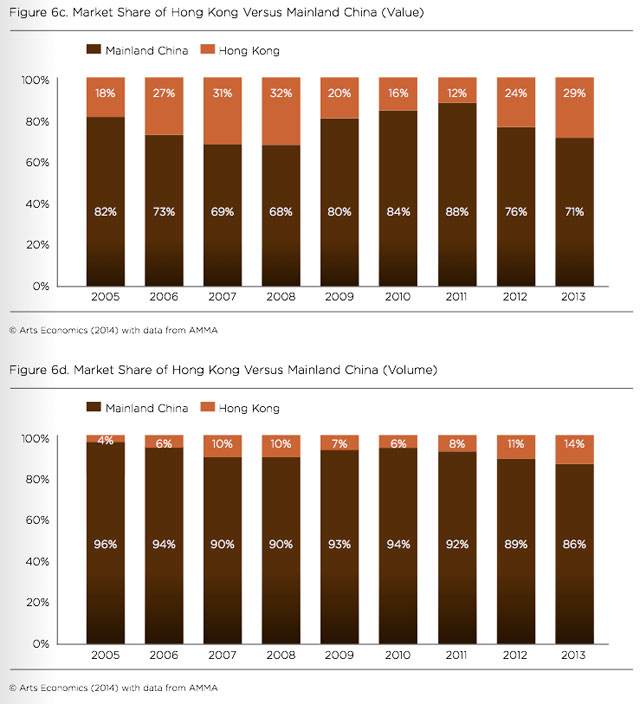

Market breakdowns by sector are also included, with postwar and contemporary art being the largest, reaching a historical peak of €4.9 billion in auction sales alone. There’s a focus on geography in relation to all different aspects of the market — value, volume, imports and exports, buyers — with special sections on the US and China. The US continues to dominate the art market, the report finds: “it had a 52% share of the value of of all lots sold for over €1 million at auction around the world. It also accounted for 78% of the volume and 60% of the value of all transactions priced over €10 million.” China, which “remains the most important of all of the newer art markets,” comes in second place, with €11.5 billion in sales.

Another notable thread concerns online sales, both at auction and for dealers. The report estimates that online sales in 2013 were in “in excess of €2.5 billion, or around 5% of global art and antique sales” and suggests that the online market could grow by as much as 25% per year (although it’s unclear where that prediction comes from). The worldwide leader in online sales was not Sothebys or Christie’s but the New York–based Heritage Auctions. And dealers were benefiting from the internet, too, with 62% of their online sales going to new buyers.

Here are a few more standouts from the long (160 pages), information-packed report:

* “In 2013, based on conservative estimates, there were 308,525 businesses selling art and antiques worldwide, consisting of

dealers, galleries, antique shops and auction houses.

* “In 2013, it is conservatively estimated that the global art trade spent €12.1 billion on a range of external support services

directly linked to their businesses. The highest single item of expenditure in 2013 by the art trade was on advertising and

marketing at €3.2 billion (26% of total spending), of which 79% was spending by auction houses.

* “Spending on art fairs, although only incurred by dealers, was the second largest at €1.9 billion.

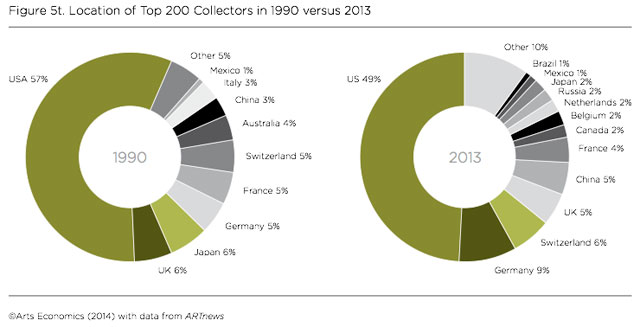

* “It can be estimated that there are at least 600,000 mid-to-high level regular collectors of art and antiques. From those, some

experts within the trade estimate that there is a group of 3,000 collectors at the highest level, at least half of these reside in

New York.

* “In 2013, dealers reported making 33% of their total sales through art fairs.

* “By far the largest share of sales (78%) in 2013 were to private collectors. On average, 9% of sales in 2013 were to museums

and other public institutions, although this ranged from 1% to 80% for different dealers.

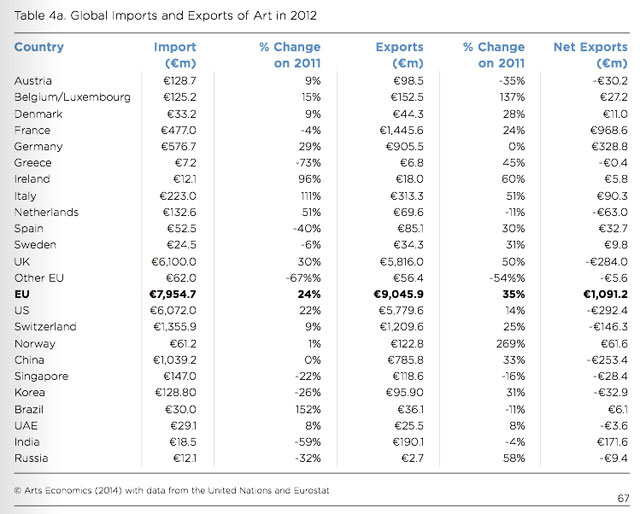

* “The UK was the largest importer and exporter of art globally and a net importer of art, with imports of €6.1 billion

exceeding exports of €5.8 billion, both just marginally ahead of the US.”

Below are a few of the more notable charts, although this only just breaks the surface. The full report can be read online.

FAMILY SITE

copyright © 2012 KIM DALJIN ART RESEARCH AND CONSULTING. All Rights reserved

이 페이지는 서울아트가이드에서 제공됩니다. This page provided by Seoul Art Guide.

다음 브라우져 에서 최적화 되어있습니다. This page optimized for these browsers. over IE 8, Chrome, FireFox, Safari